Efficient Power Supplies – An Analysis on Investment for the Future

May 18, 2023

Nico Schepers

In the search for a suitably efficient power supply, the costs play a major role, alongside the technical requirements. The focus is often on the initial purchase price, while other potential costs that may be incurred during the operation of the power supply are not taken into consideration. In this blog post, PULS demonstrates why the decision to purchase a high-quality power supply is a profitable investment for your company, by taking a close look at all the costs involved.

How Do I Find the Right Power Supply?

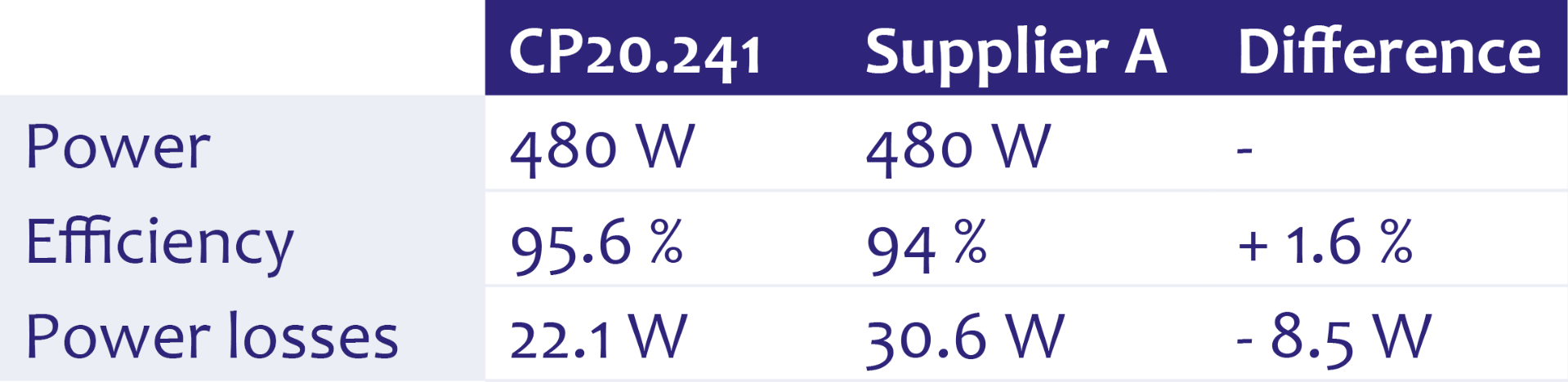

Let’s assume for a moment that you have to select a power supply for a new project and the choice is between a CP20.241 and a power supply from another manufacturer. You already know that from a technical perspective both products are suitable for your purpose.

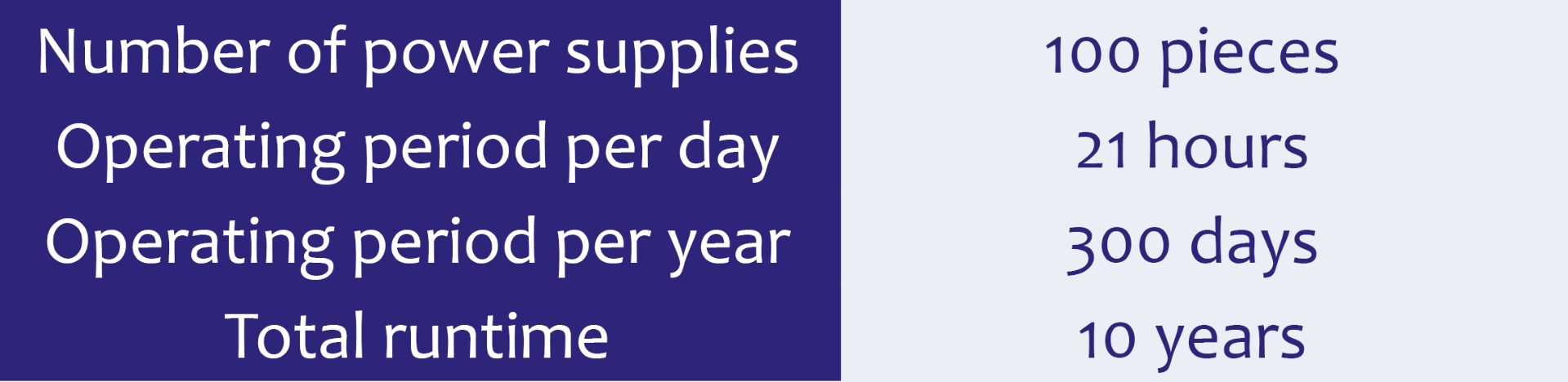

You have access to the device data in Figure 1 and the application data in Figure 2. Figure 1 shows that both power supplies produce the same power. The efficiency of the CP20.241 from PULS is 1.6 percent higher, which results in power losses that are 8.5 W lower. Figure 2 shows the relevant data for the operation of the plant.

Alongside the data from Figures 1 and 2, you also know that the purchase price of the CP20.241 is €20 more than the power supply from supplier A, which is less efficient.

You are a project buyer and you need to keep track of the project costs, so you are tending towards choosing the device with the lower purchase price.

But before you make the decision, you remember that the company has a new CFO who is currently evaluating the profitability of all the projects and who is focusing in particular on projects that are profitable in the long term. You try seeing things through the CFO’s eyes and, alongside the purchase price, you want to check the potential running costs and include them in your decision-making process.

You take a detailed look at the data and, in particular, the differences between the two devices. On the basis of the existing data, you immediately notice the power losses, which are linked to possible savings or additional costs when it comes to the electricity bill. You examine these data more closely.

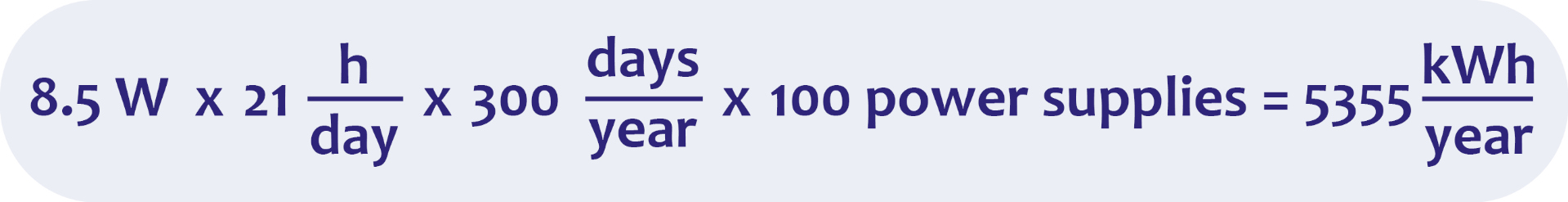

Your aim is to avoid losses as far as possible. Using the power loss figures and the application data from Figure 2, you calculate the potential energy savings over one year of operation, if you choose the more efficient power supplies:

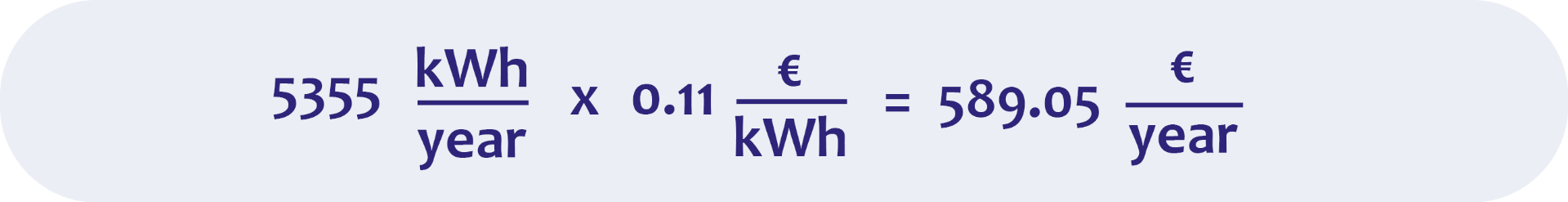

It emerges that the 100 power supplies you need could give you additional savings of 5355 kWh/year if their efficiency level is 95.6 percent instead of 94 percent. You calculate the potential cost savings on the basis of an electricity price of €0.11/kWh, which will remain the same for the next ten years. You discover that you can make savings of up to €589 per year over the entire operating period:

Note on Electricity Costs

Electricity costs fluctuate considerably over time and vary from one region to another. This means that it is not possible to generalize. In the European Union, for example, in the first half of 2022 industrial customers were paying on average €0.18/kWh (Electricity price statistics – Statistics explained (europa.eu)). In our example, we have used a low, fixed electricity cost of €0.11/kWh and disregarded future general and inflationary price increases during the operating period. Of course, higher electricity costs also result in significantly higher savings.

Purchasing a Power Supply: An Investment Decision?

You now have the following figures available when you consider the power supplies with 95.6 percent efficiency:

- Initial investment: additional costs of: 100 items x €20 = €2000

- Annual saving on electricity costs of: €589

As you have already realised, your new CFO thinks in terms of cash flows, which affect the liquidity and the value of the company. You know that an investment is profitable in the long term if you get a positive figure when you add together the initial investment and all the future cash flows. You can work out the number of years of operation that it will take for an investment to pay for itself.

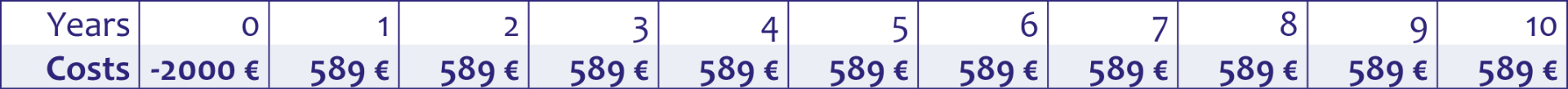

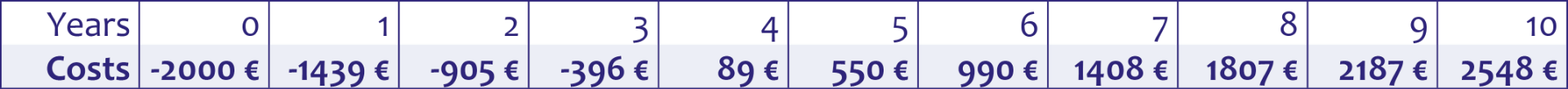

You calculate the impact that the decision about the 10-year runtime will have on the costs and savings. If you choose the 100 power supplies with 95.6 percent efficiency, the cash flows are as follows:

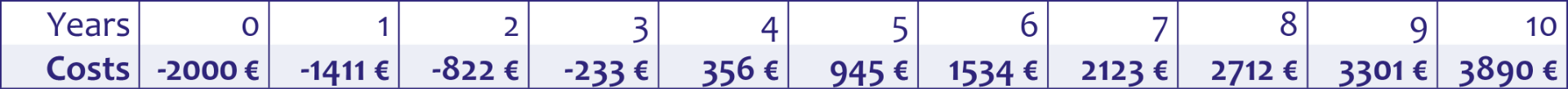

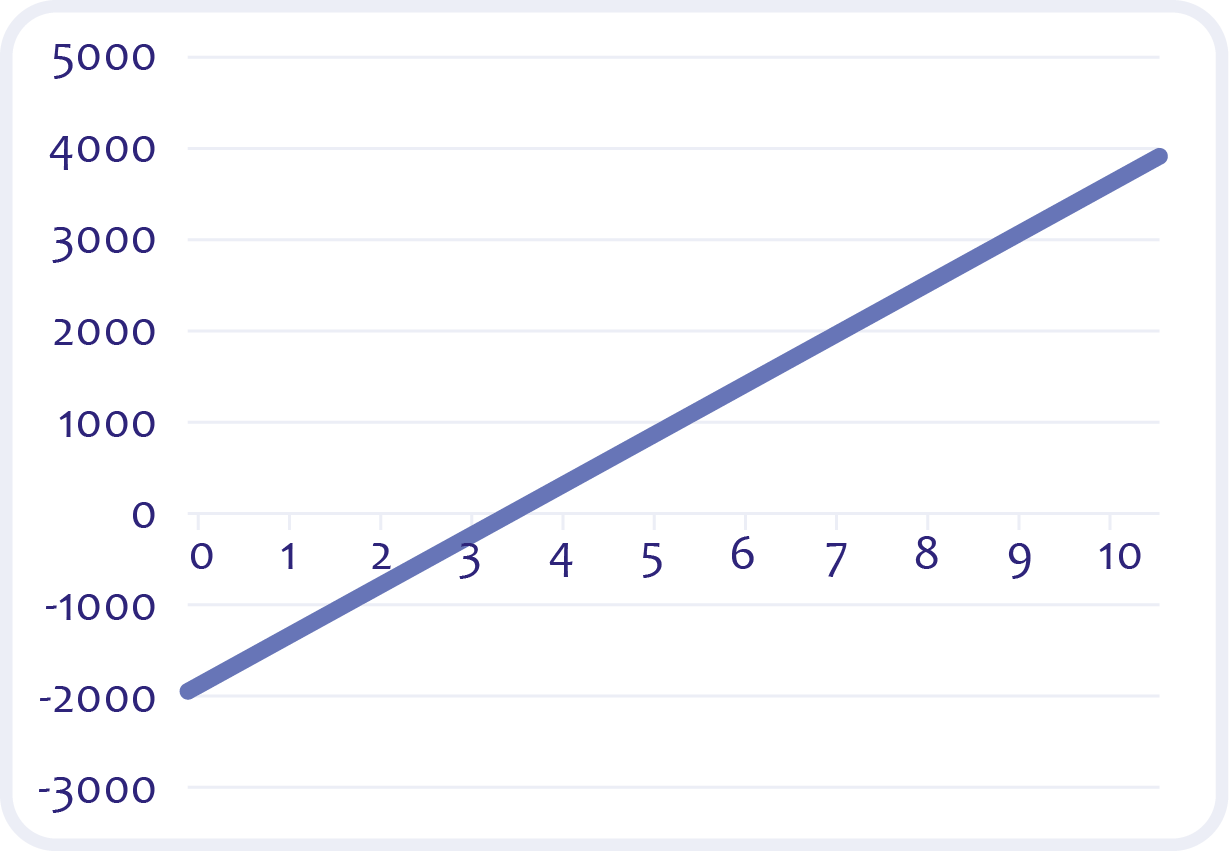

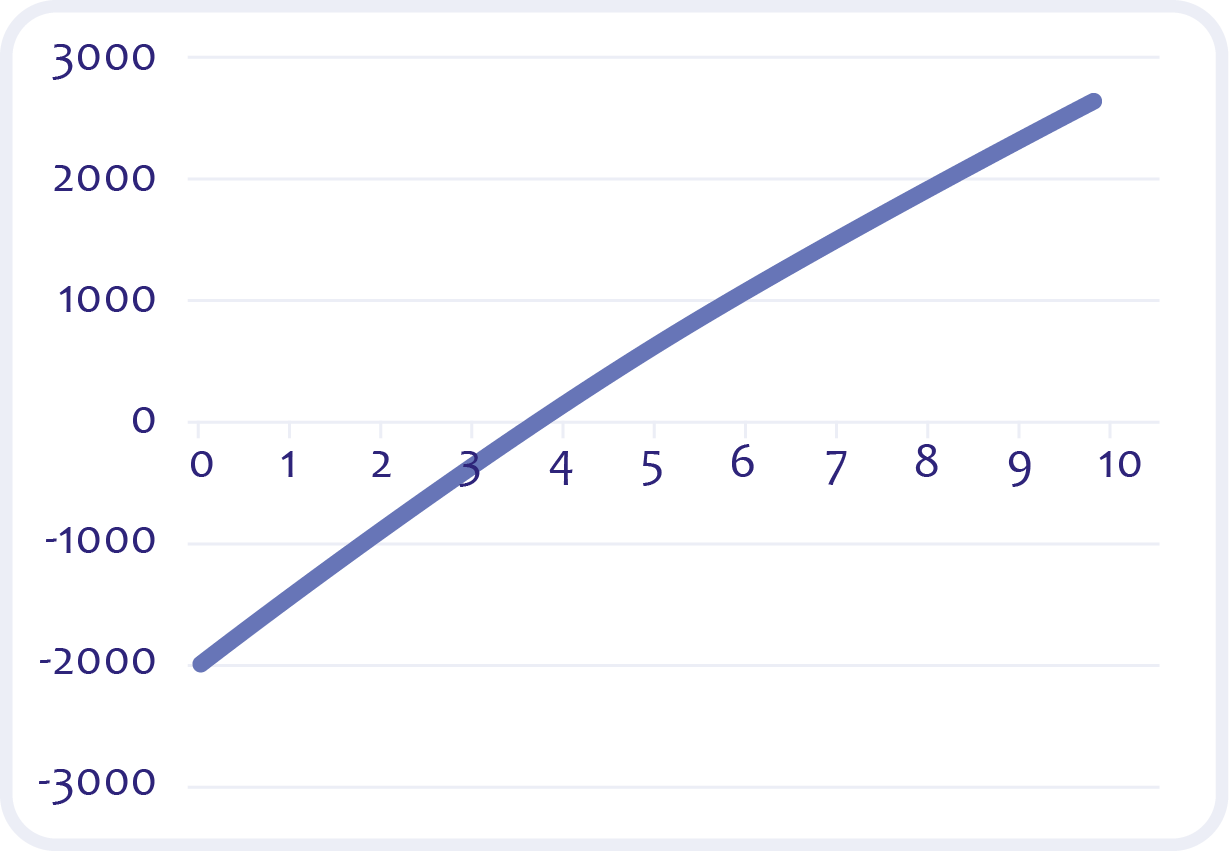

You can also work out the break-even point, which is the time when the expenses correspond to the savings.

You discover that the savings are so considerable by the fourth year that they fully compensate for the higher initial investment. With a runtime of ten years, further savings are possible. In this example, up to €3890 can be saved if future savings are taken into consideration alongside the investment costs before the purchase decision.

You are very surprised by the results and you realize that focusing only on the purchase price is too simplistic and does not form an adequate basis for decision-making.

In a brief meeting, your CFO gives you the feedback that simply comparing initial investments and future cash flows can be helpful in coming to a quick, straightforward assessment of which investment is better. However, this approach is too simple to provide a reliable basis for decision-making. Your CFO explains that, wherever possible, you should also take into the consideration the change in the value of the future cash flows.

The CFO as The Decision-Maker on Investments?

Following your meeting with the CFO, you receive an e-mail with the following information:

Dear John,

Thank you very much for the information you gave me. I think you need to extend your calculation to take into account the value of the money over time. In periods of high inflation, it is clear that future cash flows are worth less than payments made today. For example, €100 today is worth more than €100 in two years. To take these changes in value into consideration, you must discount all the future cash flows to their current value in your investment calculation.

To make a decision about an investment, you need to calculate the net present value, which discounts and adds together all the current and future cash flows. This allows you to decide on an investment on the basis of realistic figures.

I have attached a detailed explanation of net present value.

Best regards

Susanne

What is Net Present Value?

Net present value is one of the most important figures for assessing the value and the cost-effectiveness of an investment. A positive NPV means that an investment is worthwhile and will generate profits in the future.

The relevant factors in the calculation are the initial investment and all the future cash flows (inflows and outflows of funds). It is important to take into consideration the present value. Earlier cash flows have a higher value than later ones. The initial investment is then added to the discounted incoming and outgoing payments in the operating years. Alongside the payment flows, an interest rate must be included in the discount. This covers possible loan interest, the inflation rate and a risk mark-up and is normally decided on by each individual company or for each individual project.

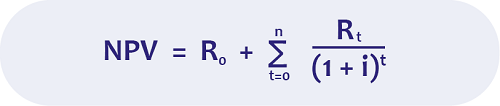

The NPV is calculated as follows:

You are very pleased to have had the input from the CFO and you try out the new calculation. To take into account inflation and loan interest, you use a fictitious interest rate of 5 percent. The result is as follows:

You realise that the future cash flows discounted against the current value are much lower than in the previous calculation. However, it is clear that using this approach the investment will also start to pay for itself in the fourth year and that additional savings of more than €2500 are possible over ten years of operation.

You have now completely rejected your original idea of choosing the cheaper option with the lower level of efficiency. Despite the higher initial investment, you opt for the more efficient power supplies, which means that your company is making an investment that is profitable in the long term.

Efficient Power Supplies Increase Sustainability

It is obvious that alongside the financial considerations, the efficient power supplies also contribute to increased sustainability. In our example, in addition to the financial benefit over the 10-year operating period, there is also a reduction in CO2 emissions of around 19.6 tonnes (5355 kWh/year x 10 years x 0.366 kg CO2/kWh). Would you like to find out more about this? Then take a look at our blog post “How do efficient power supplies contribute to CO2reduction?“

This explains how highly efficient power supplies can make a valuable contribution to more climate-friendly and sustainable industrial production by reducing energy wastage and therefore also CO2 emissions.

Summary

This simple example makes it clear that from a financial perspective the choice of a power supply should not be based solely on the initial purchase price. A calculation of this kind is too simplistic and, in many cases, will result in significantly higher costs in the future.

Our sales specialists will be happy to advise you on your choice of power supply. They will also help with investment calculations and take your specific cost factors and regional requirements into consideration. You are welcome to contact us.