Stellarator Coil Manufacturing Market is Projected to Reach $1.42 Billion by 2033

October 31, 2025

According to Research Intelo, the Global Stellarator Coil Manufacturing market size was valued at $512 million in 2024 and is projected to reach $1.42 billion by 2033, expanding at a robust CAGR of 11.7% during the forecast period of 2025 to 2033. The primary factor propelling the growth of the stellarator coil manufacturing market globally is the accelerating investment in nuclear fusion research and the increasing number of large-scale fusion projects, particularly those focusing on advanced stellarator designs.

As the global energy sector intensifies its pursuit of sustainable and safe alternatives to conventional power generation, stellarators are gaining prominence due to their potential to provide stable, continuous, and clean energy. This surge in research activities and the need for highly sophisticated magnetic confinement systems are fueling demand for innovative coil manufacturing technologies and materials, thus driving market expansion.

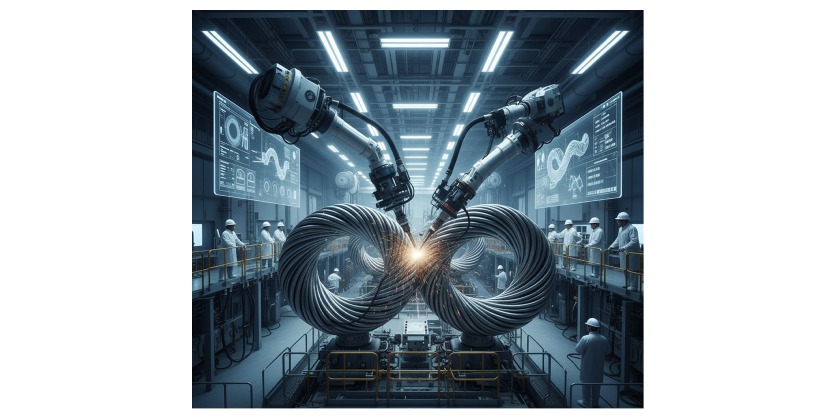

As the global demand for clean and limitless energy intensifies, the stellarator coil manufacturing market has emerged as a pivotal segment in the pursuit of practical nuclear fusion. Stellarators complex magnetic confinement devices designed to sustain plasma for extended periods depend heavily on intricately engineered magnetic coils. These coils generate the twisting magnetic fields needed to confine hot plasma without direct physical contact. With major fusion research projects like Wendelstein 7-X (W7-X) and Helically Symmetric Experiment (HSX) setting technological benchmarks, the manufacturing of stellarator coils is rapidly evolving into a specialized and strategic industrial domain.

Market Dynamics and Growth Drivers

Global Push Toward Fusion Energy

The surge in government and private sector investment in fusion research is the principal driver of the stellarator coil manufacturing market. Projects such as W7-X in Germany, Helion Energy’s prototypes, and Japan’s Large Helical Device (LHD) highlight international efforts to harness fusion power. As fusion energy progresses toward commercial feasibility, the demand for next-generation stellarator coils capable of handling higher magnetic fields and longer operational cycles continues to grow.

Technological Advancements in Superconductors

The market’s evolution is closely tied to innovations in high-temperature superconductors (HTS). These materials can operate at relatively higher temperatures and magnetic field strengths than traditional superconductors, reducing cooling requirements and improving performance. Companies investing in HTS-based coil technologies are expected to gain a competitive edge as these materials enable compact, more efficient stellarator designs.

Rising Collaboration Between Research Institutes and Industry

A growing number of public-private partnerships (PPPs) are accelerating coil production capabilities. Collaborations between universities, national laboratories, and engineering firms ensure the transition of fusion concepts from laboratory-scale to prototype reactors. This integration of academic precision and industrial scalability is fostering a new generation of specialized manufacturing facilities capable of producing complex coil geometries at a reduced cost and timeline.

Challenges in Stellarator Coil Manufacturing

High Production Complexity and Cost

Each stellarator coil is a feat of engineering precision, often requiring custom tooling, 3D shaping, and extensive quality control. The intricate geometry necessitates multi-axis winding machines, vacuum resin impregnation, and dimensional verification using laser metrology. These processes significantly increase production time and cost, making the overall project economically demanding.

Limited Standardization

Unlike conventional electrical coils, stellarator coils are not standardized. Every reactor design requires unique configurations tailored to specific magnetic field requirements. The absence of standardized design templates makes scalability challenging, limiting the ability to mass-produce or streamline coil fabrication.

Material Constraints and Cryogenic Demands

Superconducting materials like NbTi or Nb₃Sn require operation at ultra-low temperatures (around 4 Kelvin). Maintaining these conditions places immense stress on insulation systems, vacuum integrity, and cooling structures. Any defect in manufacturing or assembly could compromise the entire fusion experiment, underscoring the need for flawless quality assurance and continuous R&D investment.

Future Outlook

The stellarator coil manufacturing market is on the brink of transformation, propelled by both technological maturity and geopolitical energy ambitions. As fusion research transitions from experimental to pre-commercial phases, the need for reliable, scalable, and cost-efficient coil production will intensify. The next decade is expected to witness a shift toward modular coil architectures, AI-driven quality control, and sustainable superconducting materials that minimize environmental impact.

If fusion reactors achieve commercial viability, stellarator coil manufacturers will play a central role in shaping the post-carbon energy economy, establishing themselves as foundational contributors to one of humanity’s most ambitious scientific pursuits.

Competitive Landscape

Prominent companies operating in the market are:

- General Atomics

- Siemens Energy

- Toshiba Energy Systems & Solutions

- Mitsubishi Heavy Industries

- ASG Superconductors

- Cryomagnetics, Inc.

- Babcock Noell GmbH

- Hitachi, Ltd.

- Oxford Instruments

- Luvata

- Furukawa Electric Co., Ltd.